Dear clients and friends,

Like many of you and your businesses, our industry is concerned with what’s in store for the rest of the year as inflation, interest rates, supply chains, labor markets and other factors continue to impact the economy and create more uncertainty. At the same time, we continue to hear from companies and individuals across several industries who have plans to grow and invest.

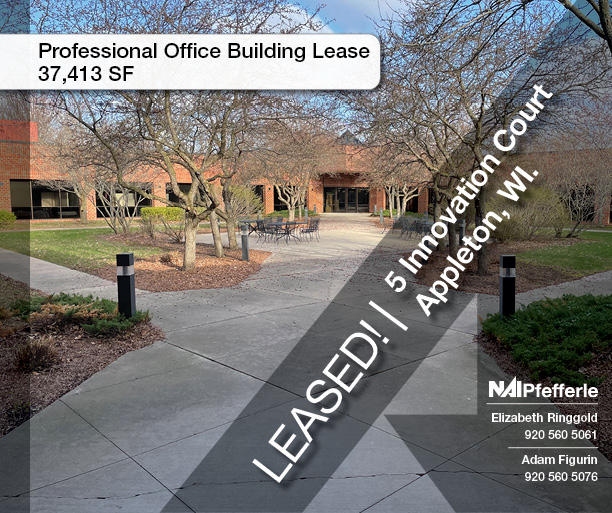

Year-to-date through Q2, our brokerage team closed more than 140 commercial real estate transactions in 40 different municipalities. The property types and uses varied, from a 175-room riverfront hotel in Oshkosh, to a 30,000 SF retail center in Sheboygan, to a 495,000 SF industrial building in Wausau, just to name a few. It’s clear, nonetheless, that an increasingly constricted credit environment for businesses, developers and consumers is contributing to a slowdown in the market. Demand for turnkey industrial space is still strong but slowing down, while rents continue to grow due to low vacancies and new construction. Retail and restaurants are coming back, although some retailers are holding back on replenishing inventories until there’s more clarity on the end-consumer and future spending habits. Multifamily continues to benefit from strong housing fundamentals but also facing cost, labor and supply chain pressures. And the office sector is still trying to catch up as more office users implement hybrid work schedules. The U.S. office vacancy rate in Q12023 hit 17.8% – the highest in 30 years – compared to Wisconsin, where vacancies have hovered between 7.5% and 8% for the last two years.

In a rapidly-changing market, we hope to continue to be a resource. Click on the sample local market reports below, or reach out directly for additional market data from Wisconsin or around the country.

Manny Vasquez, VP / Partner, mannyv@naipfefferle.com