Happy New Year!

The local CRE market was active in the last quarter of 2023. Industrial and Retail transactions dominated Q4 in the markets that we serve, as demand for light and heavy industrial space, as well as retail space, continued. Retailers including c-stores, discount stores, car washes, grocers and fast food restaurants continue to open new locations, some with smaller footprints and a stronger focus on smaller markets.

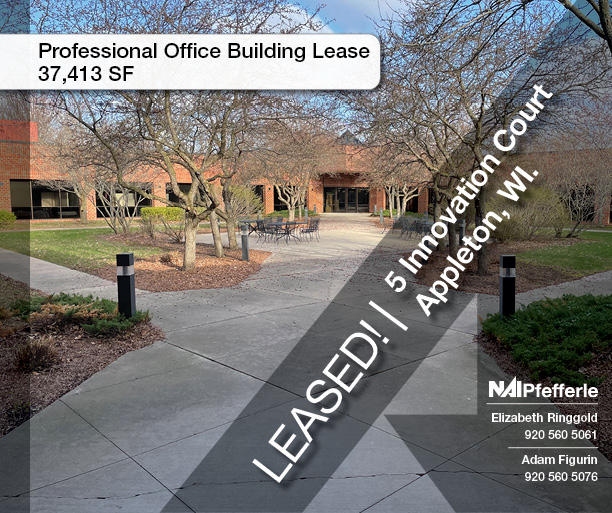

As expected, the Office sector remained pretty quiet, although we continue to see a “flight for quality” and a desire to be in amenities-rich locations. However, even as more companies return to the office, hybrid work arrangements will continue to limit the growth of office demand. It’ll be interesting to see if more redevelopment projects continue to repurpose vacant office space (provided that costs and zoning regulations allow it).

Demand for land, specifically for Multifamily development, is also steady, as more apartment units continue to flood the market to address a longstanding housing shortage. Nationally, the biggest wave of new apartment supply in decades is expected to temper rent growth and improve affordability for renters in 2024.

We’re optimistic that commercial real estate Investment activity will begin to pick up in the second half of 2024 as interest rates begin their gradual decrease.

Click on the sample local market reports below or reach out directly for additional market data from Wisconsin or around the country!

Manny Vasquez, VP/Partner, mannyv@naipfefferle.com